| IPs and trend of Japanese investors | |

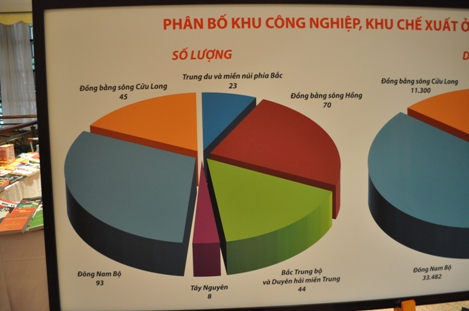

Viipip.com – The development of IPs and EPZs in Vietnam, has marked the impacts of trend industrial development of provinces, regions and country in 20 years. Their important contributions in field of economy and society were noted the report of provinces, regions and center and on magazines and communication networks. At the end of 2001, there are 283 IPs and EPZs of 76000ha. Picture 1 shows the area partition of IPs and EPzs in 6 zones in country. Southeast region and the Mekong Delta attract more 50% about the number of IPs and EPZs and total land-used area. Picture 1: IPs-EPZs in Vietnam by area (ha) Source: Industrial park magazine Picture 2: IPs-EPZs in Vietnam by quantity Source: Industrial park magazine Sustainable development problem for IPs/EPZs in country is interested by government authorities and IP Management Board in provinces. Ensuring to build the sustainable development criteria of valuation system for IPs/EPZs, need time and efforts of agency coordination. In 2012, due to general situation of global economic downturn, foreign investors came to invest in IPs/EPZs in Vietnam decreasingly. Domestic clients (tenants) have postponed their resettlement plan for factories. Some observations have seen owners (developers) of IPs/EPZs trying to find a new ways of attracting tenants (investors). The traditional way in attracting investors is less effective and IPs/ EPZs can’t wait investors to come, they ought to have a better marketing plan to reach potential domestic and foreign customers. The foreign investors recently come from Asian, European countries etc. Earlier months of 2012, according to a survey of Vietnam Industrial Park Investment Promotion (Viipip.com), Domestic investors’ interest tends to decrease while Japanese investors’ interest tends to increase dramatically. In recent years, there are 2 types of Japanese investors: 1. The trend of specific investment (renting from the first investors) With rather large land scale, from a few hectares to tens of hectares, the secondary investors (tenants) call for investment and develop infrastructure depending on the model of clusters or IPs for specific industry. They rent land, hold and sublease to small customers (often investing in production field of supporting industry). This model is quite popular, can find in motorcycle-car assembly field, wooden furniture...However, there is an attention that leasing price of land from the first investors is rather low (wholesale price of raw land – no infrastructure). However, in recent 2-3 years, this trend goes slowly under many reasons. This trend has been developed in some regions, including (i) The South: At Long An, Vung Tau, Binh Duong and Tay Ninh. (ii) The North: At Vinh Phuc, Hai Phong, Hung Yen, Bac Ninh, while it doesn’t appear in the Central Vietnam. 2. Ready-Built Factory Small and medium Japanese investors are looking for ready – built factory from 500m2 – 5,000m2. Geographic position of IPs is the first choice. The first choice this group includes packaged services, land and infrastructure which are ready totally. They are ready to pay price of lease land from 3.6-5.0 USD/m2/month. IPs/EPZs owner (developer) are also changing themselves to satisfy the demand of Japanese customers by supplying minimum land areas to the lowest area of 2,000m2 now, the lowest factory area of 500m2. Especially, in Binh Duong the RYOBI Hub model from building factories with a small size to added services and facilities, marketing and sales advisory staff in Japanese style is highly appreciated by Indochina Int’l Consulting Co - IICo (owner of Viipip.com). However, many IPs/EPZs planned their industrial park many years ago, land – using plan was rather large (above 1ha). To meet this trend, owners of IPs/EPZs are standing at crossroads – change their master plan or constructing ready – built factories. To change master planning, they need time and capital but it’s very difficult in present situation. Many of those are interested in building ready-built factory. In general, Japanese customers require a ready land and infrastructure beside packaged services, possibility to expand their investment in future, especially convenient transportation. Via Viipip.com survey, IP owners are trying their best in finding and meeting Japanese customer’s demand. A new industrial park in Hai Phong and other in Vung Tau are in planning stage, In Long Thanh (Dongnai), a Japanese investor has being carried out a plan of about 100 ha IP (80% leased by Japanese customers) till the end of 2011. Another one in Long An was attracted 35 Japanese companies in 2011 and has the consolidating plan to promote investment in 2012 and 2013. | |

| Dr. Ton That Tu - Chairman of Indochina Int’l Consulting |