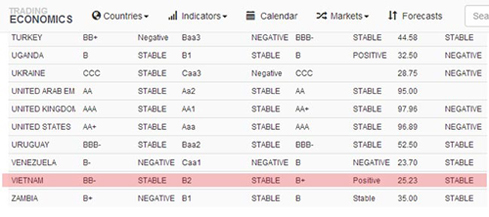

| S&P, Fitch, Moody’s raise Vietnam’s credit ratings | |

Vietnam’s economy seems to be starting on the road to recovery. The website www.tradingeconomics.com last week noted that Vietnam’s economic situation was now “stable”, based on Standard & Poor’s August announcement of the country’s BB- (stable) credit rating and Moody’s sovereign debt rating of B2 (stable). Fitch similarly gave Vietnam a B+ (stable) credit rating in late July. Trading Economics provides users with economic data, including 300,000 economic indicators, for 196 countries. Andrew Colquhoun, head of Asia-Pacific sovereign debt at Fitch Ratings, forecasted that Vietnam would grow 5.7 per cent this year, which was “relatively high” compared to other regional economies. He said Vietnam’s economic policy had “significantly changed” after the Vinashin scandal in February 2011. Vietnam’s foreign currency reserves reached $35 billion in May this year and as well as increasing foreign direct investment, the country’s export turnover is also on the rise. A Moody’s report on Vietnam’s revised credit rating said it “represents the expectation of continued macroeconomic stability which, in turn, would further support the restructuring of the banking system and augment the country’s external payments position.” Moody’s also raised Vietnam’s long-term foreign currency (FC) bond ceiling to Ba2 from B1, as well as its long-term FC deposit ceiling to B2 from B3. The firm also raised Vietnam’s local currency country risk ceiling from Ba1 to Ba2. These revisions were attributed to Vietnam’s broad macroeconomic stability over three consecutive years. Real gross domestic product (GDP) growth averaged 5.3 per cent per year between 2012 and the first half of 2014 and inflation was reigned in to only 7.5 per cent on-year for the 26 consecutive months through July this year, a winning streak unmatched since 2000. In early August, the United Nations Economic and Social Commission for Asia and the Pacific released its economic and social survey for 2014, which stated that Vietnam’s growth “is projected to improve to 5.7 per cent amid improving credit conditions”. Continued caution regarding monetary policy and a renewed focus on structural reform, particularly the restructuring of state-owned enterprises and the banking sector, should support projected growth. Private investment was also expected to pick up, the survey said. “The economy recovered gradually from the effects of a high-inflation episode and banking sector problems. Both consumption and investment grew at a steady pace. On the supply side, services continued to grow rapidly, while manufacturing picked up in the second half of the year,” the report read. The World Trade Organization’s former director general Pascal Lamy told government leaders and local enterprises in meetings in August in Hanoi that he was quite optimistic about Vietnam’s economic performance. “Difficulties are common for all economies, however, despite the financial crisis and global economic decline, Vietnam has still seen relatively high growth,” Lamy noted. “But in order to further boost growth, Vietnam needs to boost structural reforms, improve law quality and create a level playing field for private companies,” he suggested. “It is expected that Vietnam will see big changes over the next 5-10 years.” | |

| VIR |