| Vietnam booms in FDI, becoming an "investment powerhouse" with a series of records: Surpassing the Asian "giant" |

|

7/24/2023 9:30:59 AM In the process of attracting foreign investment, Vietnam has to compete with a very strong opponent. However, reality shows that FDI inflows into Vietnam are increasing in both quantity and quality.

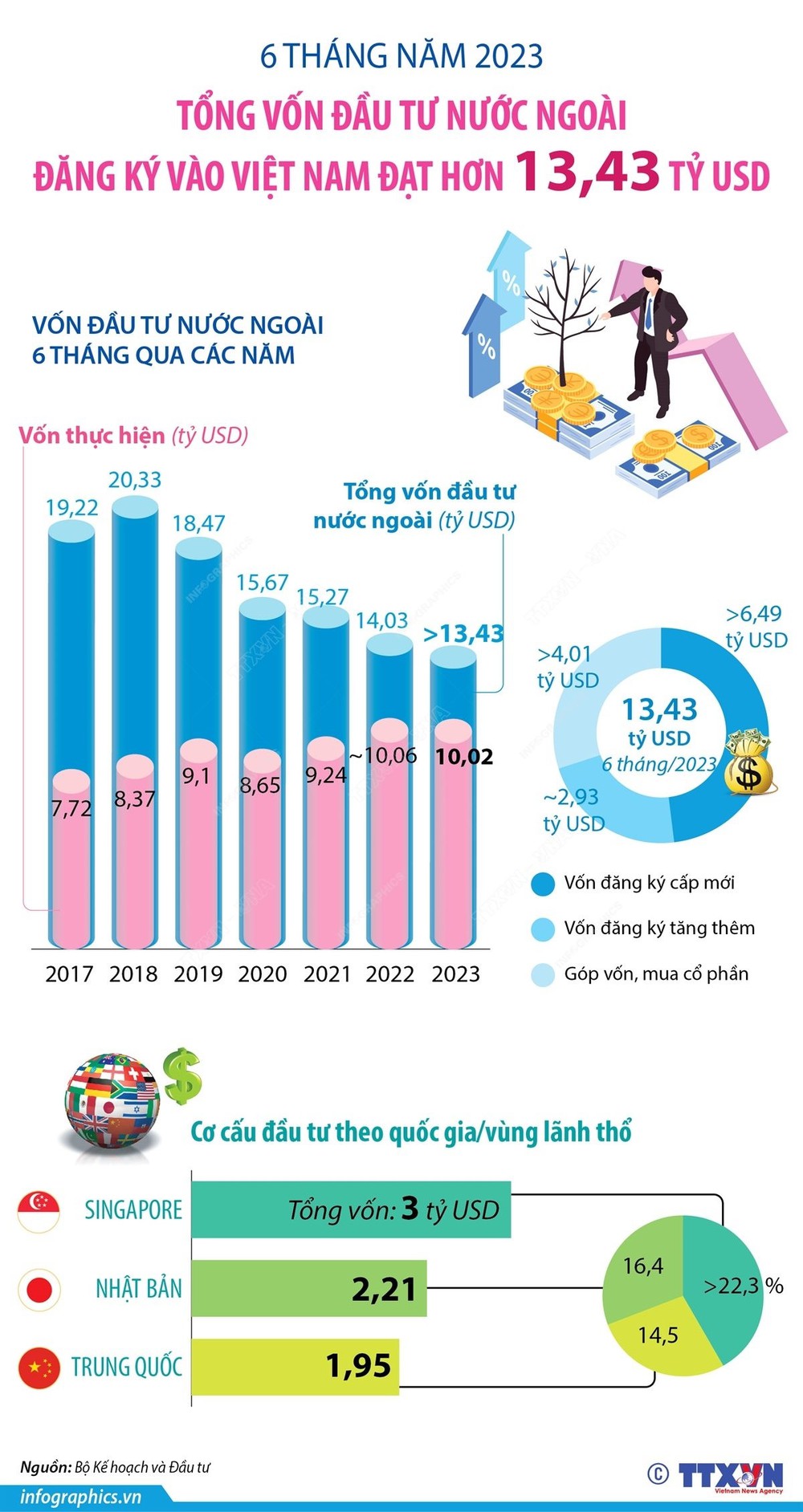

According to a report by the international economic consulting firm IEC, since integrating into the global economy in the early 1990s, Vietnam is increasingly becoming an attractive destination for foreign investors. It can be said that, when it comes to success stories of economies driven by foreign direct investment (FDI), Vietnam is an outstanding example. In particular, in the past 5 years, despite the difficulties caused by the COVID-19 pandemic or other fluctuations in the world, Vietnam has recorded an "explosion" of FDI. This capital flow, with an increase in both quantity and quality, has made an important contribution to turning Vietnam into a new production center of the world. Record milestonesForeign investment inflows into Vietnam have recorded many record milestones. According to the Government Electronic Newspaper, the total registered FDI capital in Vietnam in 2008 (as of December 19) reached 64,011 billion USD. Meanwhile, according to the "FDI Report 2016" published in the publication fDi Intelligence, in 2015, Vietnam ranked 5th in the world in terms of FDI in terms of the number of projects and 4th in terms of total investment capital (after India, China and Indonesia). This report also notes that Vietnam has the highest FDI efficiency index among emerging economies in the period 2014-2015. Since then, FDI inflows into Vietnam have tended to increase in the long-term, despite experiencing some short-term fluctuations. The new "peak" was set in 2019, right before the outbreak of the COVID-19 pandemic, with more than $38 billion in foreign investment. Although this level is still far behind the $64 billion figure of 2008, but in the context of 2019, this is considered an extremely impressive number. Entering 2021, despite the difficulties of the COVID-19 pandemic, Vietnam continues to set a new "peak" in FDI, with 38.85 billion USD of foreign investment registered in the Southeast Asian country. In 2022, 108 countries and territories have invested in Vietnam, bringing the total registered FDI in Vietnam to nearly 27.72 billion USD. In which, realized FDI capital (disbursed capital) reached a record of 22.4 billion USD, up 13.5% over the same period in 2021. This is the highest amount of realized FDI in 5 years (2017 - 2022). Worth mentioning, among these, many projects of manufacturing and manufacturing electronic and high-tech products have been capitalized on a large scale. Typically, the Samsung Electro-mechanics Vietnam project (Thai Nguyen) increased capital twice: An increase of USD 920 million (1st time) and an increase of USD 267 million (2nd time); Samsung HCMC CE Complex Electronics Co., Ltd. project increased capital over 841 million USD... Most recently, the General Statistics Office said that in the first 6 months of 2023, the total foreign investment capital into Vietnam reached more than 13.43 billion USD, equaling 95.7% over the same period, up 3 percentage points compared to the first 5 months of 2023. Singapore is currently leading with a total investment of more than 3 billion USD, accounting for more than 22.3% of total investment capital in Vietnam. Japan ranked second with nearly 2.21 billion USD (nearly 2.1 times higher than the same period). China ranked third with a total registered investment capital of more than 1.95 billion USD (up 53.5% over the same period...). Many investors from Europe and the US have also chosen Vietnam as an attractive investment destination globally. Although there are many challenges to be solved, according to Sputnik news agency (Russia), Vietnam has the opportunity and potential to become a "power" in FDI. Big rival of Asian ’giant’In the process of attracting foreign investment, Vietnam is competing with a very strong opponent, which is India. India’s advantages are cheap labor in large quantities, low production costs, an open environment to foreign investors, while the people of this country have a strong tendency to consume. India is also the 3rd largest economy in Asia, and is expected to rise, surpassing Japan and Germany to become the 3rd economy in the world (according to the rankings of the International Monetary Fund). According to experts, Vietnam will face many challenges when competing with India in attracting investment, especially in the field of electronics. However, at present, India is still "not a threat to FDI inflows into Vietnam". Mr. Michael Kokalari, Director of Macroeconomic Analysis and Market Research Department of VinaCapital, said that other multinational corporations are investing in India mainly to produce products for consumers in the domestic market. Their purpose is very different from when investing in Vietnam. Specifically, almost all products manufactured in Vietnam are intended for export, especially to the US - Vietnam’s largest export market (accounting for more than a quarter of export turnover). Meanwhile, India is pursuing a domestic market growth strategy. So multinationals invest in the country seeking to profit from a rapidly growing middle class, rather than seeing it as a manufacturing base for export. For example, Apple’s incentive to invest in India is to meet growing domestic demand. " Vietnam is pursuing the ’East Asian development model’. This is also the approach that economies like Asia’s Tiger have used to become rich. In this economic growth strategy, Vietnam focuses on manufacturing products for export to the US and other developed countries," said Mr. Kokalari . According to the expert, compared with Vietnam, there are two main reasons why companies choose not to invest much in India to produce export goods. It’s workforce (including qualifications) and strict labor laws. Vietnam is now up 12 places compared to 2021 in the Economist Intelligence Unit (EIU) "easiness to do business" ranking. "In general, at the moment, we do not think that India can hinder FDI inflows into Vietnam. We believe that FDI will still be one of the main growth drivers of Vietnam in the coming years," said Mr. Kokalari . Meanwhile, according to the Global Times (China), India and Vietnam have different development strategies due to different economic conditions. If New Delhi considers attracting foreign investment crucial to its development strategy, it may even refer to Vietnam’s experience to a certain extent. Before 2020, there was heated discussion about whether Vietnam or India would become the next manufacturing hub of the world. The situation is now clear as Vietnam’s manufacturing industry has clearly shown resilience and high growth potential during the pandemic. An important reason behind Vietnam’s rapid development is its friendly foreign investment policy, " concludes the Global Times.

|

| soha.vn |