| The West leaves orders from Vietnam, the billion-dollar export industry suddenly loses |

|

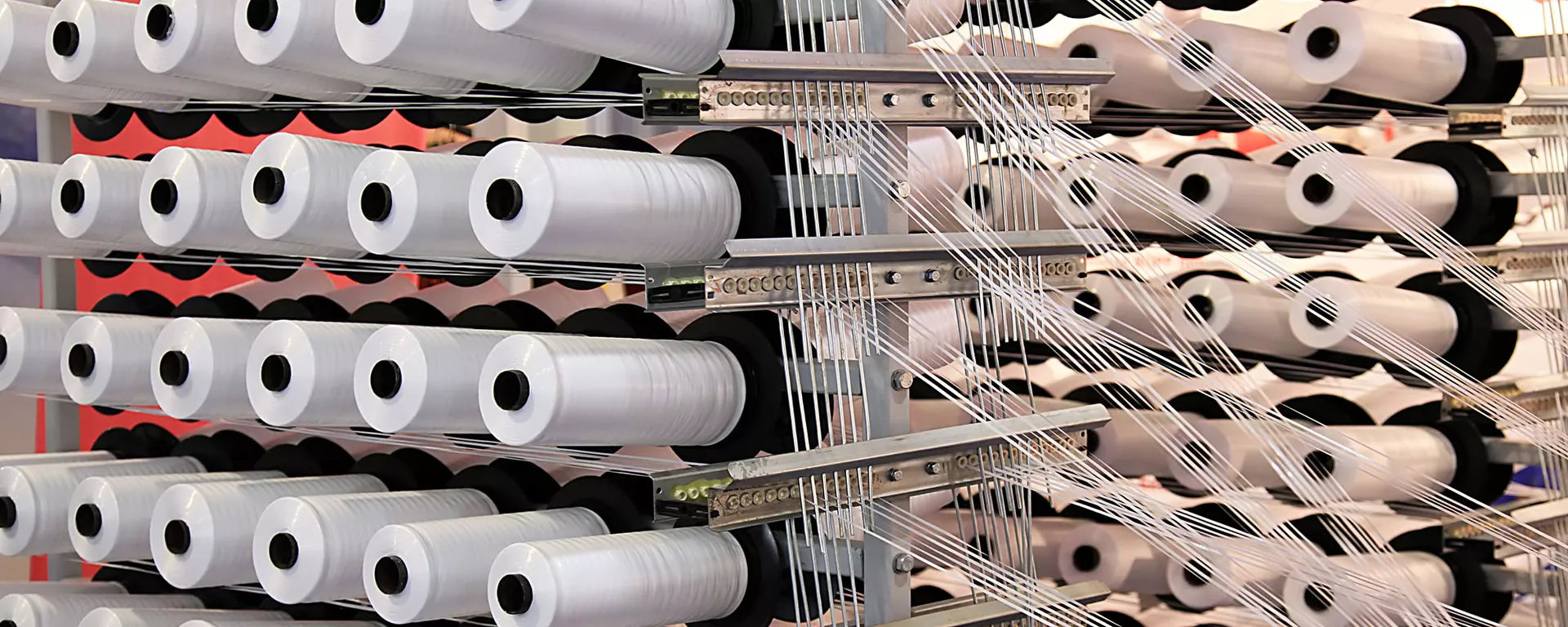

7/24/2023 10:50:27 AM Vietnam’s textile and garment industry is affected by a decrease in orders from major markets such as the US and EU. Worth mentioning, businesses are not only hungry for orders, but the unit price is also reduced by more than half. In the context that cost competition is no longer an advantage of Vietnam, the US and EU shift export orders to Pakistan, Bangladesh or India, requiring Vietnamese businesses to quickly find adaptation and change measures. Textile and garment exports declineInformation about the situation of Vietnam’s textile and garment industry in the first half of the year, the Vietnam Textile and Apparel Association (Vitas) said that businesses are in a very difficult period.

According to the Vietnam Textile and Apparel Association, in 2023, the negative impact of the epidemic and political fluctuations in the world will cause global economic growth to continue to decline (in 2021, it will increase by 6%; in 2022, it will increase by 3%; it is forecasted that in 2023 it will be around 2%).

In the first half of this year, the textile and garment industry was affected by a decrease in orders from major markets such as the US and EU .

Textile and garment export turnover in 6 months is estimated at 18.6 billion USD, down 17.6% over the same period in 2022; import turnover was estimated at 10.7 billion USD, down 20.5% and had a trade surplus of 7.9 billion USD (while in the same period in 2022, the trade surplus was 8.8 billion USD).

Vietnam’s textile and garment export turnover to major markets in the first 5 months of the year mostly decreased: the US decreased by 27.1%; EU decreased by 6.2%; Japan increased by 6.6%; Korea down 2%; Canada drops 10.9%...

This deep decrease is not only due to the impact of the economy but also comes from the pressure of "greening" the industry, the supply chain traceability directive of the Organization for Economic Co-operation and Development (OECD), the EU and the German Law on Supply Chain Appraisal (effective from January 1 this year)", the association acknowledged.

Besides, Vitas said, although the State Bank has reduced operating interest rates 4 times, but due to high deposit rates from the end of 2022, loan interest rates are still high. Enterprises do not have access to support packages, for example, reducing interest rates by 2% with a package of VND 40,000 billion.

Unprecedented storyPreviously, as reported, speaking at the meeting, sharing about the production and business situation in the first 6 months of the year and the forecast for the second half of the year of the Vietnam National Textile and Garment Group (Vinatex) taking place at the end of June 2023, Mr. Cao Huu Hieu, General Director of Vinatex said frankly, that the situation of the textile industry is very difficult.

The biggest common point from the fourth quarter of 2022 to the first six months of this year is that the orders are very small and fragmented. Mr. Cao Huu Hieu affirmed that "there has never been a precedent for a garment enterprise with a scale of several thousand employees to receive an order of 500-700 jackets, but now it has to be done".

The reason is because "if you don’t do it, the first is that the customer doesn’t know you and the second is that the business will not have an order".

Mr. Cao Huu Hieu noted that in order to overcome difficulties and challenges, in the coming time, Vinatex determined to focus on key solutions such as: promoting market forecasting, support, and giving orientation so that units can actively plan production.

In addition, production is organized in a flexible direction, meeting small orders, changing quickly, difficult, urgent time.

The garment industry flexibly converts items to ensure that orders meet market demand. The yarn industry researches new items and new markets to catch the trend.

"Hungry" ordersThe Vietnam Textile and Apparel Association forecasts that the production and export situation will gradually improve, but difficulties will continue until the end of 2023, because many businesses have not yet had enough orders for the third and fourth quarters.

In addition to the lack of orders, accepting orders is not their strength, businesses also face difficulties due to the deep reduction in unit prices, even by over 50% compared to normal.

In 2023, the whole textile and garment industry sets a goal to strive for exports of 39-40 billion USD. To accomplish the goal, Vitas leader Vu Duc Giang told Thanh Nien that Vietnamese textile and garment enterprises need to focus on three core issues.

Firstly, find solutions to retain employees, especially the core force; organize vocational skills training classes, train human resources for green and digital transformation.

Second, retain customers, accept orders that are not strengths, are not profitable to have jobs for employees and let customers not move elsewhere; build a reliable, long-term partnership; exploiting new markets, paying attention to the domestic market.

Third, minimize the unnecessary expenses of the business.

The advantage of cheap labor is no longer availableOn July 19, according to the Commodity Exchange of Vietnam (MXV), export orders were shifted to Pakistan or India in the context that the cost advantage no longer belongs to Vietnam.

However, this is the "golden" time for Vietnamese businesses to look deeply into the problem and overcome the core shortcomings that are outstanding.

Pham Quang Anh, Director of the Vietnam Commodity News Center, said that the world economy still faces many challenges, especially the unexpected recovery of China which is and will continue to be a big obstacle in increasing demand for cotton products. Therefore, cotton prices may maintain a pullback trend in the near future.

From the end of 2022 until now, cotton prices have been quite stable, mainly struggling with a small range in the range of 1,800-1,900 USD/ton. The Commodity Exchange of Vietnam (MXV) updated that, the price of cotton traded on the Intercontinental Exchange (ICE) as of the end of July 18 was at $1,847/ton, down nearly 1.5 times from the high price of nearly $2,700/ton recorded in August last year.

Stable cotton prices are a good thing for big cotton importing countries like Vietnam. However, the price dropped suddenly from high to low and showed no sign of recovery, making the textile and garment enterprises that had held their goods before could not react.

"The difference in input material prices makes the cost of producing textiles and garments still high compared to countries that are not too dependent on inputs like Vietnam, which hinders the receipt of orders," according to the MXV leader.

In addition, not only is the immediate cause of the impediment of raw material prices, but the weakening of textile and garment exports also stems from the intrinsic factors of production.

It should be noted that the problem of labor intensiveness, cheap labor, which are familiar words when referring to Vietnam’s textile and garment industry. In previous years, these two factors have always been an advantage for Vietnam’s textile and garment industry to compete with big rivals such as Bangladesh, India ,....

With that advantage, the textile and garment industry has become the main export industry of Vietnam when contributing over 10% to the annual export turnover. However, in the past few years, along with the development of the labor market, the advantages of cheap labor in Vietnam are gradually waning.

The Vietnam Commodity Exchange (MXV) noted that the average monthly salary of garment workers in Vietnam is at $300, higher than the global average of $200/person.

Even, the salary in the textile industry in Vietnam is 3 times higher than the salary of 95 USD/person/month in Bangladesh or 145 USD/person/month in India, countries that are directly competing for garment orders with Vietnam.

Wage growth in the textile and garment sector is a good sign for workers’ lives, as well as showing the industry’s capacity.

“However, labor costs are not as cheap as before, which will also somewhat limit Vietnam’s competitiveness. On the positive side, this is a driving force for the industry to improve production technology and product quality," emphasized MXV’s leader.

Change to get back on trackExperts say that, although Vietnam is still in the period of golden population structure, the abundance of labor supply is also more limited than in the previous period.

The bright spot is the improvement of the level of labor, but that requires the Vietnamese textile and garment industry to transform into more diverse competitive advantages, not only focusing on cheap labor as before.

On the other hand, Vietnam’s textile and garment industry also needs a green transformation to match the inevitable trends and sustainable development standards.

Mr. Pham Quang Anh recommended that, in order to achieve the goal, Vietnamese businesses need to focus on forecasting the situation of cotton prices in the world to have reasonable price insurance strategies, increasing stability and sustainability for the billion-dollar export industry.

At the same time, in order for Vietnam’s textile and garment industry to quickly return to the export race, the shift towards green production to meet the new needs of the market is inevitable.

"Besides, improving the forecasting of raw material prices is a catalyst for the transformation and development of Vietnam’s textile and garment industry to happen faster," the expert recommended.

|

| Sputniknews |