INDOCHINA INTERNATIONAL CONSULTING CO., LTD

HO Add: 62L/36 Nguyên Hồng, Ward 11, Bình Thạnh District, HCMC - Vietnam

Biz Office Add: #48 Road No 11, Quarter 6, Hiệp Binh Chánh Ward, Thủ Đức, HCMC - Vietnam

®Source: http://viipip.com should be clearly quoted for any use of information extracted from our website.

Publication permit No: 60/GP-TTĐT , April 05, 2010.

VIR’s Hanh Linh talks with the chamber’s executive director Csaba Bundik on the factors contributing to this change and what Vietnam should do to maintain a stable index.

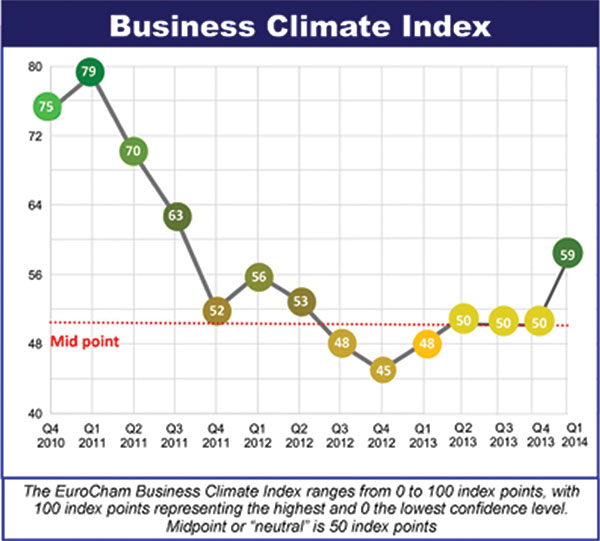

EuroCham’s quarterly survey conducted in February 2014 saw the BCI move above the midpoint for the first time since 2012- up from 50 to 59. Why the change?

The rise is likely to be linked to the upswing of sales and general business optimism around the Tet period, as we have experienced in previous years. However, an increase of nine percentage points seems to suggest that other factors such as the decreased fear of inflation, confidence in the macro-economic outlook and the hope of the conclusion of an implementable EU-Vietnam free trade agreement(FTA) later in the year are at work.

About 42 per cent of survey respondents found the past year to have been more profitable – explaining the jump from last year’s BCI of 48 to this year’s 59. However, it should be noted that a considerable 32 per cent found the past 12 months to have been less profitable.

The business climate index could decrease again next quarter as we have seen in the past. What will keep the index on an upward trend sustainably in your view?

We believe that if Vietnam addresses the cross-sectoral issues of pricing, the role of the state sector and intellectual property rights, the business environment will improve. It is important to note that the coming years will determine the longer term future of Vietnam – if the government is successful in addressing the issues identified by the business community and a comprehensive FTA is agreed, then Vietnam will be a very strong regional player. Foreign direct investment will further increase both in quantity and quality and EU enterprises will increasingly perceive Vietnam as their ASEAN hub or even headquarters, from where they can efficiently service both ASEAN markets and neighbouring countries.

EuroCham therefore believes that this is the opportunity for the Vietnamese government to demonstrate its future economic aspirations and send a clear signal to the business community that Vietnam is ready to do business.

These recommendations are clearly in the long term interest of the Vietnamese government and population: the economy can only grow sustainably if the business climate is favourable, if there is a level playing field; if corruption and the resulting inefficiencies are banished; and if government bureaucracy and oversight are reasonable.

Over the past two years the Vietnamese tax authorities have been very concerned about foreign-backed firms applying extensive transfer pricing manoeuvres to evade tax. One interesting finding from the EuroCham survey is when respondents were asked to assess the impact of the transfer pricing debate on the business environment in Vietnam, 38 per cent found it to have a negative impact, with an additional 57 per cent finding it to have minor or no impact. How justified is the concern among the authorities on the issue in your view?

The application of transfer pricing mechanisms is an internationally-accepted practice and EuroCham members are acting in accordance to high compliance standards and in line with the law. We should also remember that there may be any number of good reasons behind reported losses, in particular in recent years with the companies in Vietnam feeling the effects of the global financial crisis.

Justifiable reasons for losses include a significant reduction in top-line revenue (reduced demand, increased discounting, etc); excess fixed costs supporting much lower turnover; excess inventories and related carrying costs; bad debts; increased financing costs; and significant increases in commodity prices affecting the price of raw materials. For these reasons, companies are incurring real losses and, but it is likely that they will continue to receive attention from the tax authorities.

Vietnam has comprehensive transfer pricing regulations (Circular 66) that require foreign companies to prepare documentation to prove that their prices are in line with legislation. In addition annual transfer pricing declarations are required to be filed disclosing related party transactions and the pricing methodology adopted.

The Vietnamese tax authorities are focusing on arrangements they believe have been made to import losses from overseas associates through non-market pricing. For example, increases in inbound management service charges are a particular area of focus and there have already been cases where significant tax has been reclaimed and large penalties imposed.

Analysts are divided over whether the economic situation in Vietnam in 2014 will be better or worse than 2013. What is your view?

Better. The Vietnamese government has done a very good job at a macro level in the last two years. Two years ago the inflation rate was 22 per cent, now it is in single digits at below seven per cent. Foreign currency reserves have doubled and the domestic currency is very stable. We also anticipate more good news such as foreigners being able to buy up to 60 per cent of a listed company in Vietnam and changes in the banking and finance sector. The government recently relaxed rules on foreign ownership in local banks which creates more opportunities for foreign investors. Non-performing loans are also an issue and the Vietnamese government started to manage. We see step by step changes and they make us a bit more optimistic.

- FDI capital continues to pour into Vietnam (6/11/2025 1:20:33 PM)

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people (6/11/2025 1:15:09 PM)

- Industrial Park Real Estate: Waiting for the New Generation of FDI (6/11/2025 1:10:15 PM)

- A wealthy Vietnamese city will have two special economic zones after the merger (6/11/2025 1:04:42 PM)

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund (6/11/2025 12:55:26 PM)

- the 2nd largest city in the North will start construction on an international economic zone (6/11/2025 12:50:20 PM)

- Japanese giant Sumitomo continues to want to build an industrial park in the countrys fourth smallest province. (6/11/2025 12:40:45 PM)

- 3 foreign corporations want to invest billions of dollars in Ba Ria - Vung Tau (6/11/2025 12:34:30 PM)

- Lotte Group member starts construction of nearly 1,000 billion VND logistics center in the province with the most industrial parks in Vietnam (6/11/2025 12:33:26 PM)

- Forming a regional center for manufacturing spare parts and components (6/11/2025 12:24:08 PM)

- Vietnams first wafer factory is about to start construction (6/11/2025 12:19:09 PM)

- Dong Nai attracts foreign investors (6/11/2025 12:13:27 PM)

- Tay Ninhs largest industrial park welcomes a $150 million high-end knitted fabric factory project (6/11/2025 12:11:00 PM)

- (6/11/2025 12:09:10 PM)

- Vietnam will become a destination for Chinese investors in the future (11/6/2023 1:03:19 PM)

- FDI capital continues to pour into Vietnam

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people

- Industrial Park Real Estate: Waiting for the New Generation of FDI

- A wealthy Vietnamese city will have two special economic zones after the merger

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort

MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort Nha Trang’s Twin Towers project licenced

Nha Trang’s Twin Towers project licenced Foreign investors still have good opportunities in Vietnam

Foreign investors still have good opportunities in Vietnam Sierra Wireless gets a foot in Vietnam’s ICT market

Sierra Wireless gets a foot in Vietnam’s ICT market