INDOCHINA INTERNATIONAL CONSULTING CO., LTD

HO Add: 62L/36 Nguyên Hồng, Ward 11, Bình Thạnh District, HCMC - Vietnam

Biz Office Add: #48 Road No 11, Quarter 6, Hiệp Binh Chánh Ward, Thủ Đức, HCMC - Vietnam

®Source: http://viipip.com should be clearly quoted for any use of information extracted from our website.

Publication permit No: 60/GP-TTĐT , April 05, 2010.

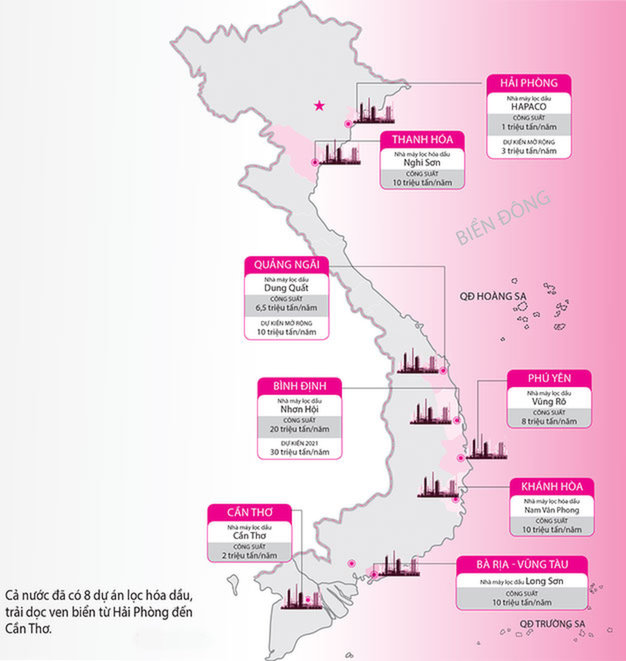

Even though the country now has only one such operating facility, located in the central province of Quang Ngai, many other projects have been planned and proposed across the country – from the northern to central, south-central, and southern regions.

That facility is Dung Quat Oil Refinery, whose capacity is 6.5 million tons a year.

The said eight plants have a total design capacity of 60 million tons of oil products a year.

Vietnam’s oil refinery map

PetroVietnam, the country’s oil and gas giant, is working with a joint-venture on the construction of the Nghi Son Refinery in the north-central province of Thanh Hoa, while another facility, with a capacity of 1 million tons per year, is planned to be built reportedly in Hai Phong City, situated in northern Vietnam.

It was reported in 2006 that Hai Phong-based HAPACO Group was eyeing a refinery project in the city’s Dinh Vu Industrial Zone.

On September 9, the US$3.2 billion Vung Ro refinery project broke ground in Phu Yen Province, located in south-central Vietnam, where two other facilities are also under consideration.

Petrolimex, Vietnam’s largest fuel wholesaler, has been working with its partners on a project to set up the Nam Van Phong oil refinery, with a capacity of 10 million tons a year, in Khanh Hoa Province since 2008, while a megaproject worth $22 billion has also been proposed in Binh Dinh Province.

Earlier this month, the Ministry of Industry and Trade called on the Prime Minister to add the Nhon Hoi oil complex in Binh Dinh, to be developed by Thai energy firm PTT Pcl, to the planned development of the country’s oil and gas sector between 2015 and 2025.

The Nhon Hoi project is designed to have a total capacity of up to 20 million tons of products per year during its first phase, according to the industry and trade ministry.

In the southern region, PetroVietnam is carrying out an investment study on the 10 million ton a year Long Son refinery in the coastal province of Ba Ria-Vung Tau, while another plant in the Mekong Delta city of Can Tho received in-principle approval from the Prime Minister in 2008.

The Can Tho refinery is expected to be developed by Vietnam’s VIT Corp and US-based Semtech Limited B.V.I.

Too close to each other

While there have been few updates on the refinery projects in Hai Phong, Can Tho or Ba Ria-Vung Tau, the Nhon Hoi facility has grabbed the most media attention as the trade ministry has been actively selling the plan to have the project implemented.

But the project has raised a few eyebrows among industry insiders and experts, including oil and gas behemoth PetroVietnam, which said the $22 billion facility would result in a supply surplus for the country, as the oil projects planned for the 2015-2025 period are already enough to meet domestic demand.

A PetroVietnam official also told Tuoi Tre (Youth) newspaper that Nhon Hoi’s proposed location is too close to the Vung Ro, Nam Van Phong, and Dung Quat projects, which would thus affect the latter’s investment attraction.

The trade ministry admitted in a document submitted to the Prime Minister that the implementation of the Nhon Hoi refinery will cause difficulties for the smaller facilities in the region.

But it rejected claims that the Nhon Hoi project would affect the operations of other facilities.

The ministry said the Binh Dinh facility will not enjoy the incentives and preferential treatments of the other operating and under-construction projects.

Le Tuan Phong, deputy head of the General Department of Energy under the Ministry of Industry and Trade, said Nhon Hoi will not result in abundant supply for the domestic market as its products are targeted for export.

The Ministry of Planning and Investment has backed the proposal to add the Nhon Hoi project to the oil and gas sector’s masterplan, according to documents obtained by Tuoi Tre.

But the ministry suggested that the trade ministry compile additional reports about the project’s socio-economic effectiveness and the target markets for the refinery’s products.

The industry and trade ministry noted that being added to the sector’s plan is not enough for such a huge project with as many risks as Nhon Hoi to be realized.

The project’s implementation relies on many other factors, including capital arrangement, the ministry said.

It also proposed that the Prime Minister remove the Can Tho refinery from the oil and gas sector’s plan, and extend the completion time of the Long Son facility later than 2025.

- FDI capital continues to pour into Vietnam (6/11/2025 1:20:33 PM)

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people (6/11/2025 1:15:09 PM)

- Industrial Park Real Estate: Waiting for the New Generation of FDI (6/11/2025 1:10:15 PM)

- A wealthy Vietnamese city will have two special economic zones after the merger (6/11/2025 1:04:42 PM)

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund (6/11/2025 12:55:26 PM)

- the 2nd largest city in the North will start construction on an international economic zone (6/11/2025 12:50:20 PM)

- Japanese giant Sumitomo continues to want to build an industrial park in the countrys fourth smallest province. (6/11/2025 12:40:45 PM)

- 3 foreign corporations want to invest billions of dollars in Ba Ria - Vung Tau (6/11/2025 12:34:30 PM)

- Lotte Group member starts construction of nearly 1,000 billion VND logistics center in the province with the most industrial parks in Vietnam (6/11/2025 12:33:26 PM)

- Forming a regional center for manufacturing spare parts and components (6/11/2025 12:24:08 PM)

- Vietnams first wafer factory is about to start construction (6/11/2025 12:19:09 PM)

- Dong Nai attracts foreign investors (6/11/2025 12:13:27 PM)

- Tay Ninhs largest industrial park welcomes a $150 million high-end knitted fabric factory project (6/11/2025 12:11:00 PM)

- (6/11/2025 12:09:10 PM)

- Vietnam will become a destination for Chinese investors in the future (11/6/2023 1:03:19 PM)

- FDI capital continues to pour into Vietnam

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people

- Industrial Park Real Estate: Waiting for the New Generation of FDI

- A wealthy Vietnamese city will have two special economic zones after the merger

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort

MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort Nha Trang’s Twin Towers project licenced

Nha Trang’s Twin Towers project licenced Foreign investors still have good opportunities in Vietnam

Foreign investors still have good opportunities in Vietnam Sierra Wireless gets a foot in Vietnam’s ICT market

Sierra Wireless gets a foot in Vietnam’s ICT market