INDOCHINA INTERNATIONAL CONSULTING CO., LTD

HO Add: 62L/36 Nguyên Hồng, Ward 11, Bình Thạnh District, HCMC - Vietnam

Biz Office Add: #48 Road No 11, Quarter 6, Hiệp Binh Chánh Ward, Thủ Đức, HCMC - Vietnam

®Source: http://viipip.com should be clearly quoted for any use of information extracted from our website.

Publication permit No: 60/GP-TTĐT , April 05, 2010.

Industrial Park Vietnam, Dong Nai province is located in the center of the Southern Key Economic Zone, which is the most dynamic economic development region in Vietnam. In the first quarter of 2022, the province’s GRDP increased by more than 6.1% and Dong Nai became the province with the highest economic growth in the Southeast region, followed by Binh Duong with more than 5.3%, Tay Ninh with more than 4%, and Binh Duong with over 4%. Phuoc nearly 3%, Ho Chi Minh City nearly 1.9% and finally Ba Ria - Vung Tau.

Dong Nai is the first province to develop an industrial park and is currently one of the leading provinces in industrial development in Vietnam. Currently, there are 3 large corporations under Dong Nai Province, namely Tin Nghia Corporation (UpCOM: TID), Industrial Park Development Joint Stock Corporation (Sonadezi - UpCOM: SNZ) and Industrial Corporation. Dong Nai food (Dofico).

In which, Dong Nai Provincial People’s Committee owns 100% of Dofico capital and 99.5% of Sonadezi’s capital. The Dong Nai Provincial Party Committee is holding 48% of Tin Nghia’s capital.

Tin Nghia and Sonadezi both operate in the business of industrial park infrastructure. In addition, Tin Nghia also trades in petroleum; processing and exporting agricultural products, coffee; business services warehouse, port, logistics. Sonadezi also operates in the fields of clean water supply, port service business, waste treatment, housing and infrastructure, etc.

And Dofico produces and trades cigarettes, trade - services, tourism, animal husbandry, plantation and exploitation of rubber latex, import and export activities, exploitation of mineral resources....

In 2021, the three companies mentioned above brought in VND 14,776 billion in revenue and VND 2,487 billion in pre-tax profit.

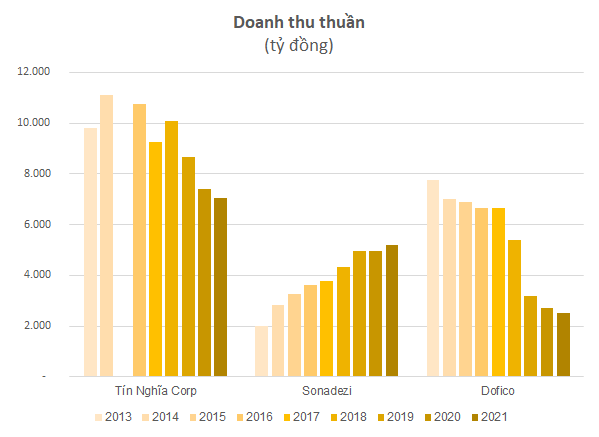

In recent years, while Sonadezi’s revenue is still growing, Tin Nghia and Sofico have recorded a decline in revenue year by year. Since 2013, Sonadezi’s revenue has increased by about 1.5 times while that of Tin Nghia and Dofico have decreased by 28% and 68% respectively.

Sonadezi’s main source of revenue comes from industrial park business when it brings in more than 1,400 billion VND, besides that revenue from providing clean water also brings in more than 1,100 billion VND, port services nearly 900 billion, waste treatment 800 billion .

Meanwhile, Tin Nghia’s main revenue comes from selling semi-finished products and goods with nearly 5,700 billion VND, industrial park business only brings in about 893 billion VND. However, Tin Nghia’s industrial zone business segment has a profit of nearly 600 billion VND in 2021, while the sales of goods will only profit 132 billion VND, even in 2020 there will be a loss of 17 billion VND.

The industrial parks that Tin Nghia is investing in include Ong Keo Industrial Park, Dat Do Industrial Park, An Phuoc Industrial Park, Tam Phuoc... And Sonadezi’s industrial parks include Bien Hoa, Chau Duc, Giang Dien, and Long Thanh Industrial Parks. , Bien Hoa...

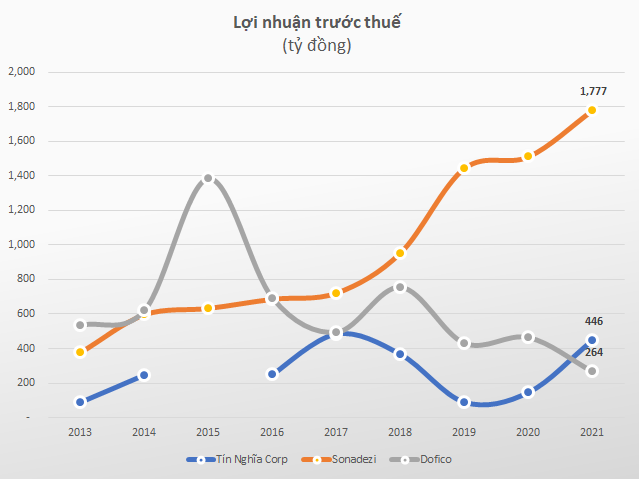

Similar to the growth of revenue, Sonadezi’s profit also increased sharply from VND 376 billion in 2013 to VND 1,777 billion in 2021, 4.7 times higher.

In 2021, Tin Nghia’s pre-tax profit was also recorded at VND 446 billion, an increase of 2 times compared to 2020. Besides the thriving business, in 2021, Tin Nghia also made a profit of VND 147 billion due to divestment. Subsidiaries.

In contrast to the two companies above, Dofico only made a pre-tax profit of VND264 billion in 2021, down 43% compared to 2020 and the lowest since 2013.

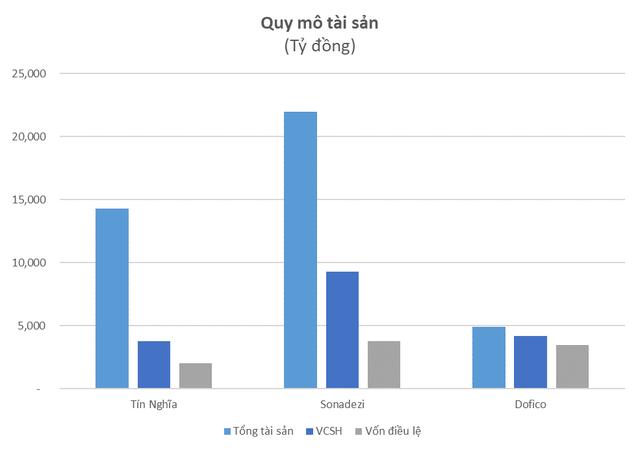

Sonadezi’s total assets are the largest with nearly VND 22,000 billion, Tin Nghia VND 14,300 billion, Dofico more than VND 4,900 billion. Dofico’s debt/equity ratio is low at 0.2 and Sonadezi’s is at 1.4; Tin Nghia is 2.8.

Recently, the Public Security Agency prosecuted and detained Mr. Quach Van Duc, former General Director and Chairman of the Board of Directors of Tin Nghia Corporation (UpCOM: TID) who was arrested for investigation. violating regulations on management and use of state assets, causing losses and waste related to violations during the implementation of the Long Tan - Phu Thanh residential area project. Besides, Mr. Duc owns more than 8.8 million TID shares, equivalent to 4.41% shares.

- FDI capital continues to pour into Vietnam (6/11/2025 1:20:33 PM)

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people (6/11/2025 1:15:09 PM)

- Industrial Park Real Estate: Waiting for the New Generation of FDI (6/11/2025 1:10:15 PM)

- A wealthy Vietnamese city will have two special economic zones after the merger (6/11/2025 1:04:42 PM)

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund (6/11/2025 12:55:26 PM)

- the 2nd largest city in the North will start construction on an international economic zone (6/11/2025 12:50:20 PM)

- Japanese giant Sumitomo continues to want to build an industrial park in the countrys fourth smallest province. (6/11/2025 12:40:45 PM)

- 3 foreign corporations want to invest billions of dollars in Ba Ria - Vung Tau (6/11/2025 12:34:30 PM)

- Lotte Group member starts construction of nearly 1,000 billion VND logistics center in the province with the most industrial parks in Vietnam (6/11/2025 12:33:26 PM)

- Forming a regional center for manufacturing spare parts and components (6/11/2025 12:24:08 PM)

- Vietnams first wafer factory is about to start construction (6/11/2025 12:19:09 PM)

- Dong Nai attracts foreign investors (6/11/2025 12:13:27 PM)

- Tay Ninhs largest industrial park welcomes a $150 million high-end knitted fabric factory project (6/11/2025 12:11:00 PM)

- (6/11/2025 12:09:10 PM)

- Vietnam will become a destination for Chinese investors in the future (11/6/2023 1:03:19 PM)

- FDI capital continues to pour into Vietnam

- Thanh Hoa receives good news: Preparing to have an additional industrial park of up to 470 hectares, creating jobs for nearly 30,000 people

- Industrial Park Real Estate: Waiting for the New Generation of FDI

- A wealthy Vietnamese city will have two special economic zones after the merger

- 30 billion USD capital FDI in Việt Nam by 2025, a series of "ông big" races to expand the land fund

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia

ADB: Vietnam’s 2009 GDP growth to be highest in South East Asia MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort

MGM Grand Ho Tram: Vietnam’s First ‘Las Vegas Style’ Integrated Resort Nha Trang’s Twin Towers project licenced

Nha Trang’s Twin Towers project licenced Foreign investors still have good opportunities in Vietnam

Foreign investors still have good opportunities in Vietnam Sierra Wireless gets a foot in Vietnam’s ICT market

Sierra Wireless gets a foot in Vietnam’s ICT market